Entry For Interest On Income Tax Refund . Web to record income tax expense, you will need to make a journal entry that includes a debit to income tax expense and a credit to. Should your business make a journal entry for income. Web 4.1 for interest expense and borrowing costs to be deductible under section 14(1)(a) of the ita, the comptroller of income tax (“cit”). Web amount of income tax refund will be credited to p&l account being an item of income in the year in which it is. You do not need to. Web if you do, you need to know how to record a journal entry for income tax refund in your books. Web the interest on income tax refund is liable to tax under the head ‘income from other sources’. Web you must declare the full amount of your taxable interest under 'other income' in your income tax return.

from www.studocu.com

You do not need to. Web the interest on income tax refund is liable to tax under the head ‘income from other sources’. Web if you do, you need to know how to record a journal entry for income tax refund in your books. Web 4.1 for interest expense and borrowing costs to be deductible under section 14(1)(a) of the ita, the comptroller of income tax (“cit”). Should your business make a journal entry for income. Web you must declare the full amount of your taxable interest under 'other income' in your income tax return. Web amount of income tax refund will be credited to p&l account being an item of income in the year in which it is. Web to record income tax expense, you will need to make a journal entry that includes a debit to income tax expense and a credit to.

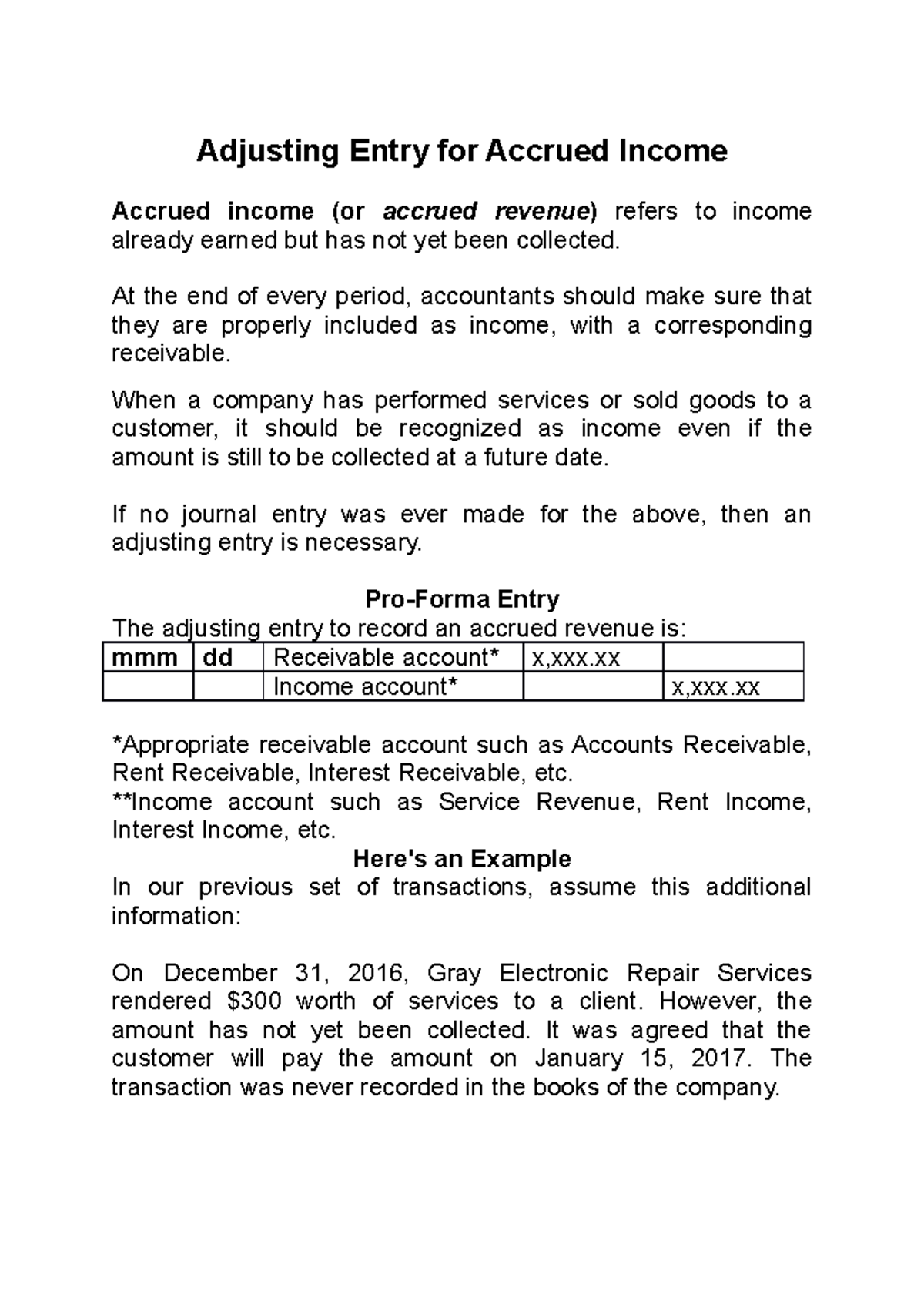

Adjusting Entry for Accrued Adjusting Entry for Accrued

Entry For Interest On Income Tax Refund Web to record income tax expense, you will need to make a journal entry that includes a debit to income tax expense and a credit to. Web to record income tax expense, you will need to make a journal entry that includes a debit to income tax expense and a credit to. Web 4.1 for interest expense and borrowing costs to be deductible under section 14(1)(a) of the ita, the comptroller of income tax (“cit”). Should your business make a journal entry for income. Web amount of income tax refund will be credited to p&l account being an item of income in the year in which it is. You do not need to. Web the interest on income tax refund is liable to tax under the head ‘income from other sources’. Web if you do, you need to know how to record a journal entry for income tax refund in your books. Web you must declare the full amount of your taxable interest under 'other income' in your income tax return.

From www.taxscan.in

No information in respect of Interest on Tax Refund to tax Entry For Interest On Income Tax Refund Web 4.1 for interest expense and borrowing costs to be deductible under section 14(1)(a) of the ita, the comptroller of income tax (“cit”). Web the interest on income tax refund is liable to tax under the head ‘income from other sources’. Web amount of income tax refund will be credited to p&l account being an item of income in the. Entry For Interest On Income Tax Refund.

From cexaxbnz.blob.core.windows.net

Tax Refund Tally Entry at Gary Sims blog Entry For Interest On Income Tax Refund Should your business make a journal entry for income. Web amount of income tax refund will be credited to p&l account being an item of income in the year in which it is. Web you must declare the full amount of your taxable interest under 'other income' in your income tax return. You do not need to. Web the interest. Entry For Interest On Income Tax Refund.

From taxrefundhomer.blogspot.com

Tax Refund Accounting Tax Refund Journal Entry Entry For Interest On Income Tax Refund Web you must declare the full amount of your taxable interest under 'other income' in your income tax return. Web if you do, you need to know how to record a journal entry for income tax refund in your books. Web amount of income tax refund will be credited to p&l account being an item of income in the year. Entry For Interest On Income Tax Refund.

From www.coursehero.com

[Solved] Edgar Detoya, tax consultant, began his practice on Dec. 1 Entry For Interest On Income Tax Refund You do not need to. Web if you do, you need to know how to record a journal entry for income tax refund in your books. Web 4.1 for interest expense and borrowing costs to be deductible under section 14(1)(a) of the ita, the comptroller of income tax (“cit”). Web to record income tax expense, you will need to make. Entry For Interest On Income Tax Refund.

From www.chegg.com

Solved Adjusting Journal Entries (AJE’s) 1. Entry For Interest On Income Tax Refund Web you must declare the full amount of your taxable interest under 'other income' in your income tax return. Web amount of income tax refund will be credited to p&l account being an item of income in the year in which it is. Web to record income tax expense, you will need to make a journal entry that includes a. Entry For Interest On Income Tax Refund.

From oncomi.netlify.app

Journal Entry For Tax Payable Entry For Interest On Income Tax Refund Web the interest on income tax refund is liable to tax under the head ‘income from other sources’. Web you must declare the full amount of your taxable interest under 'other income' in your income tax return. Web amount of income tax refund will be credited to p&l account being an item of income in the year in which it. Entry For Interest On Income Tax Refund.

From www.taxscan.in

ITR Refund Still not Credited? Know how to Check Tax Refund Status Entry For Interest On Income Tax Refund Web 4.1 for interest expense and borrowing costs to be deductible under section 14(1)(a) of the ita, the comptroller of income tax (“cit”). Should your business make a journal entry for income. Web amount of income tax refund will be credited to p&l account being an item of income in the year in which it is. Web you must declare. Entry For Interest On Income Tax Refund.

From saginfotech.blogspot.com

Easy Guide to Tax Refund with Interest for Taxpayer Entry For Interest On Income Tax Refund Web if you do, you need to know how to record a journal entry for income tax refund in your books. Web 4.1 for interest expense and borrowing costs to be deductible under section 14(1)(a) of the ita, the comptroller of income tax (“cit”). Web amount of income tax refund will be credited to p&l account being an item of. Entry For Interest On Income Tax Refund.

From bvnxrgbfh.blogspot.com

Tax Expense Journal Entry Journal Entries for Normal Charge Entry For Interest On Income Tax Refund Should your business make a journal entry for income. Web 4.1 for interest expense and borrowing costs to be deductible under section 14(1)(a) of the ita, the comptroller of income tax (“cit”). Web you must declare the full amount of your taxable interest under 'other income' in your income tax return. Web to record income tax expense, you will need. Entry For Interest On Income Tax Refund.

From www.patriotsoftware.com

Journal Entry for Tax Refund How to Record Entry For Interest On Income Tax Refund Web you must declare the full amount of your taxable interest under 'other income' in your income tax return. Web amount of income tax refund will be credited to p&l account being an item of income in the year in which it is. Web to record income tax expense, you will need to make a journal entry that includes a. Entry For Interest On Income Tax Refund.

From viralbake.com

Are You Waiting For Your Tax Refund? Know How Long Will It Take Entry For Interest On Income Tax Refund Web if you do, you need to know how to record a journal entry for income tax refund in your books. Web amount of income tax refund will be credited to p&l account being an item of income in the year in which it is. You do not need to. Web to record income tax expense, you will need to. Entry For Interest On Income Tax Refund.

From en.ppt-online.org

Adjusting Entries online presentation Entry For Interest On Income Tax Refund Web the interest on income tax refund is liable to tax under the head ‘income from other sources’. Web amount of income tax refund will be credited to p&l account being an item of income in the year in which it is. Should your business make a journal entry for income. Web if you do, you need to know how. Entry For Interest On Income Tax Refund.

From hadoma.com

Double Entry Accounting (2022) Entry For Interest On Income Tax Refund Web the interest on income tax refund is liable to tax under the head ‘income from other sources’. Web amount of income tax refund will be credited to p&l account being an item of income in the year in which it is. Web if you do, you need to know how to record a journal entry for income tax refund. Entry For Interest On Income Tax Refund.

From www.indiafilings.com

Interest Rate for Tax Refund Entry For Interest On Income Tax Refund Should your business make a journal entry for income. Web 4.1 for interest expense and borrowing costs to be deductible under section 14(1)(a) of the ita, the comptroller of income tax (“cit”). Web the interest on income tax refund is liable to tax under the head ‘income from other sources’. Web you must declare the full amount of your taxable. Entry For Interest On Income Tax Refund.

From www.pinterest.com

How to Estimate Your Tax Refund LoveToKnow Tax refund, Investing Entry For Interest On Income Tax Refund You do not need to. Web amount of income tax refund will be credited to p&l account being an item of income in the year in which it is. Web if you do, you need to know how to record a journal entry for income tax refund in your books. Web the interest on income tax refund is liable to. Entry For Interest On Income Tax Refund.

From gradecontext26.bitbucket.io

How To Check On Irs Refund Gradecontext26 Entry For Interest On Income Tax Refund Web 4.1 for interest expense and borrowing costs to be deductible under section 14(1)(a) of the ita, the comptroller of income tax (“cit”). Web to record income tax expense, you will need to make a journal entry that includes a debit to income tax expense and a credit to. You do not need to. Web the interest on income tax. Entry For Interest On Income Tax Refund.

From exobprxgh.blob.core.windows.net

How To Record Accrued Expense In Journal Entries at Shelley Dougherty blog Entry For Interest On Income Tax Refund Web you must declare the full amount of your taxable interest under 'other income' in your income tax return. Web to record income tax expense, you will need to make a journal entry that includes a debit to income tax expense and a credit to. Web 4.1 for interest expense and borrowing costs to be deductible under section 14(1)(a) of. Entry For Interest On Income Tax Refund.

From www.taxscan.in

Delay in Processing Tax Refund due to Technical Issues Kerala Entry For Interest On Income Tax Refund Web if you do, you need to know how to record a journal entry for income tax refund in your books. Web the interest on income tax refund is liable to tax under the head ‘income from other sources’. Web to record income tax expense, you will need to make a journal entry that includes a debit to income tax. Entry For Interest On Income Tax Refund.